invest in aging

Aging is a Megatrend

Consider the scale of the demographic shift underway: the global population aged 60 and over is projected to surge from 1 billion in 2019 to 1.4 billion by 2030 and a staggering 2.1 billion by 2050. In the United States, a pivotal moment approaches in 2030, when those over 65 will outnumber those under 18 for the first time.

Yet, we remain unprepared for this megatrend’s profound economic, political, and social impacts. Since 2016, Next50 has invested nearly $70 million in nonprofit and governmental organizations that make aging more affordable for older adults. Yet, to truly meet this megatrend moment, we must leverage every tool at our disposal, including the significant power of our endowment.

Next50’s Roadmap for Investing in Aging

Aging is often seen as either a personal responsibility or a public-sector issue. This overlooks the immense potential for both social impact and economic opportunity presented by our rapidly aging world. We are ignoring the untapped potential of capital markets.

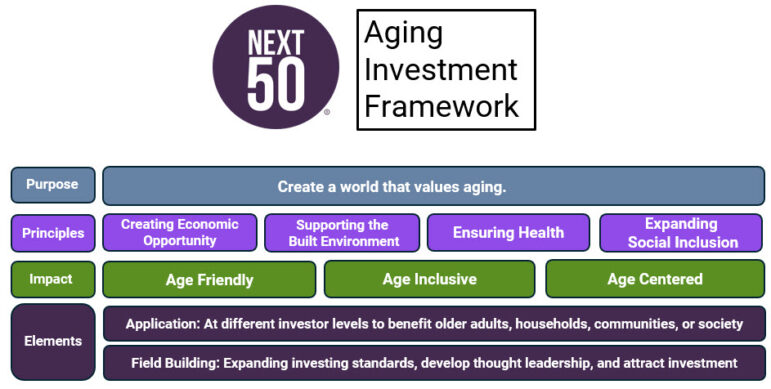

That is why Next50 recently announced that it will align its entire endowment with its mission. To do so, we created Next50’s Aging Investment Framework (AIF) – a novel approach to intentionally direct capital towards creating a world that values aging.

AIF is built upon extensive global and U.S. aging policy frameworks, distilling their core insights into four purpose-aligned principles:

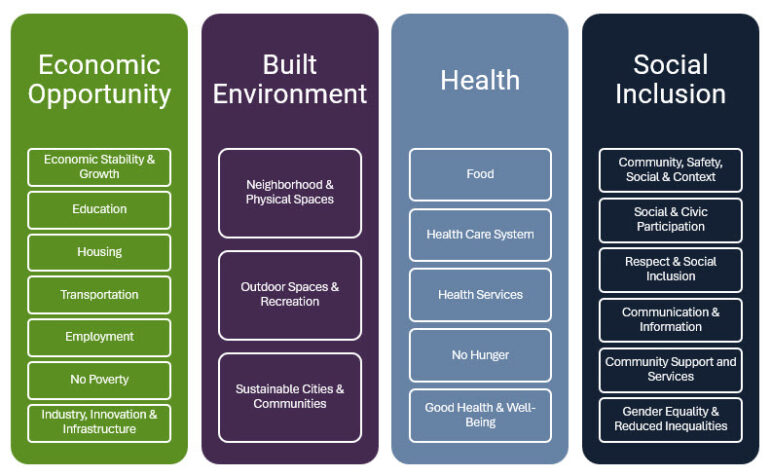

Creating Economic Opportunity (e.g. Ensuring economic stability, access to education, affordable housing, transportation, employment, and addressing poverty);

Supporting the Built Environment (e.g. Fostering age-friendly neighborhoods, physical spaces, outdoor areas, recreation, and sustainable communities);

Ensuring Health (e.g. Improving access to food, healthcare systems, health services, addressing hunger, and promoting overall well-being); and

Expanding Social Inclusion (e.g. Building community safety and context, encouraging social and civic participation, fostering respect, improving communication and information access, and supporting services that reduce inequalities).

Next50’s Aging Investment Framework is designed to be flexible, applicable across diverse portfolios – not just within traditional notions of impact investing – spanning the public and private markets, as well as all asset classes, geographies, markets, and investor types. We created an AIF taxonomy, or classification system, to help define and categorize investments based on their levels of impact:

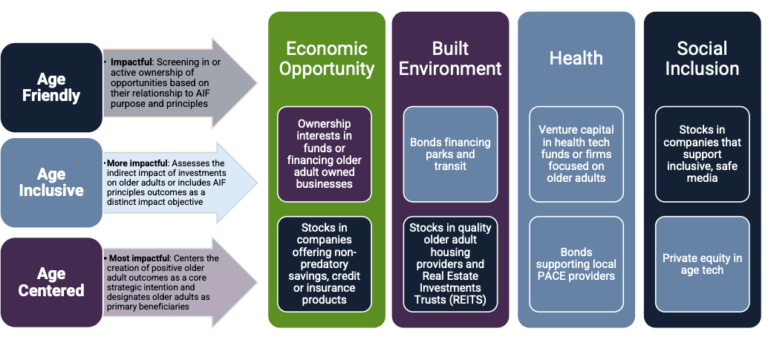

Age Friendly (Impactful):Screening in or active ownership of opportunities based on their relationship to AIF purpose and principles

Age Inclusive (More impactful): Assesses the indirect impact of investments on older adults or included AIF principles outcomes as a distinct impact objective

Age Centered (Most impactful): Centers the creation of positive older adult outcomes as a core strategic intention and designates older adults as primary beneficiaries

Below are illustrative examples of Next50’s Aging Investment Framework as applied:

Únete a nosotros

We alone can’t create a world that values aging. As we align the entirety of our endowment with our mission, join us in building an aging investment movement. We must harness the power and scope of the global capital markets to work alongside governments, civil society, philanthropy, and all of us who are aging. We seek to partner with banks, foundations, government sources, and mission-aligned intermediaries to create a world that values aging.

For specific information about our impact investing work, haga clic aquí.